Leveraging Data and AI for Efficient Fraud Detection in the Insurance Industry

Leveraging Data and AI for Efficient Fraud Detection in the Insurance Industry

- Technology : Snowflake

- Industry : BFSI

Business Objective

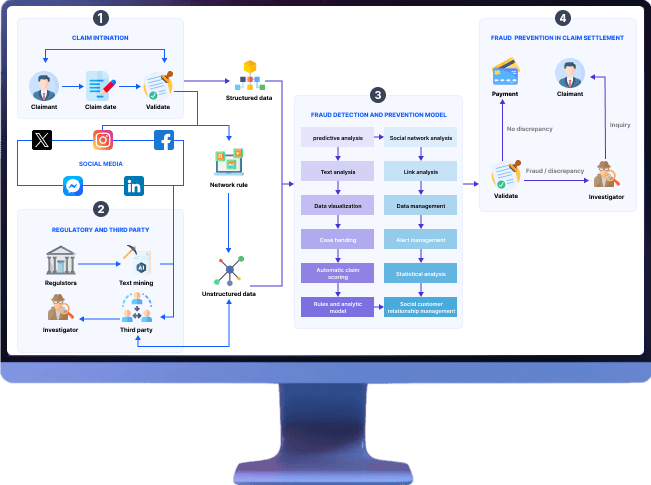

The insurance industry faces numerous challenges when it comes to detecting and preventing fraud, ranging from increasing fraud schemes to manual inspection limitations. We have been asked to develop a fraud detection system using AI for one of the leading insurance companies. Manually inspecting each claim was a time-consuming and tedious task. On the other hand, fraudulent claims resulted in financial losses, making companies. This can be prevented by developing a robust solution that utilizes data analytics and AI to identify fraudulent behavior accurately and efficiently.

Solution

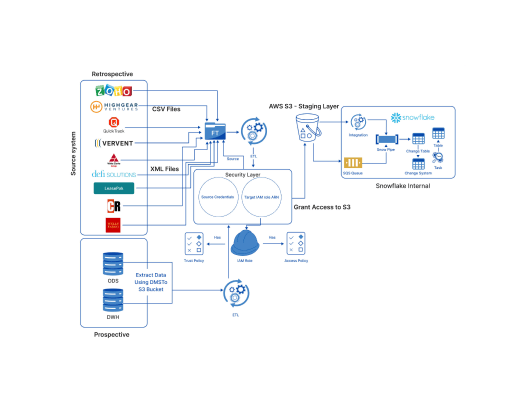

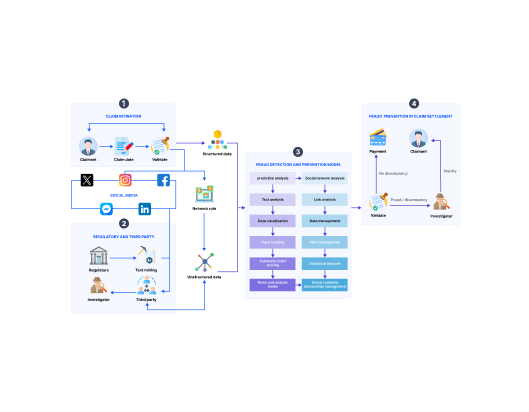

To address the challenges the insurance industry faces in fraud detection, we started with gathering and integrating a wide range of structured and unstructured data sources, including claim details, policyholder information, historical data, public records, and external databases.

To develop a customized fraud detection solution, our data team utilized advanced analytics techniques to identify patterns and anomalies in historical data, enabling the detection of potential fraud indicators. This system flags potentially fraudulent claims by analyzing the data and identifying suspicious patterns. It provides instant alerts and recommendations to claims adjusters when potentially fraudulent claims are identified.

Result

The implementation of our data-driven and AI-powered fraud detection solution yielded impressive results for the insurance company.

Enhanced Fraud Detection Accuracy:

The AI algorithm consistently identifies and reports fraudulent claims, significantly improving the detection rate compared to traditional manual inspection methods.

Time and Resource Savings:

By automating the fraud detection process, the insurance company saved thousands of hours that would have been spent on manual claim inspections, allowing employees to focus on higher-value tasks.

Improved Cost Savings:

Proactively identifying and preventing fraudulent claims led to substantial cost savings for the insurance company, reducing financial losses caused by fraudulent activities.

Increased Efficiency:

The streamlined claims processing workflow resulted in faster and more efficient claim resolution, improving customer satisfaction and retention.

Benefits

Advanced Fraud Detection:

The AI algorithm’s ability to identify complex fraud patterns enables the insurance company to stay one step ahead of fraudsters and detect fraudulent behavior that may have been missed with manual inspection methods.

Cost and Resource Savings:

By automating the fraud detection process, the insurance company significantly reduced the time, effort, and resources required for investigating fraudulent claims, leading to substantial cost savings.

Improved Operational Efficiency:

The streamlined claims processing workflow enabled faster claim resolution, reduction in claim cycle times, and improved operational efficiency.

Enhanced Customer Experience:

The client resulted in enhanced customer satisfaction and trust by detecting and preventing fraud more effectively and quickly.

Connect With Us To Leverage Data For Insights And Intelligence

Crafting Data Success Stories

Implementing Cloud Data Warehouse For A Leading Auto Finance Company

Leveraging Data and AI for Efficient Fraud Detection in the Insurance Industry

Crafting Data Success Stories

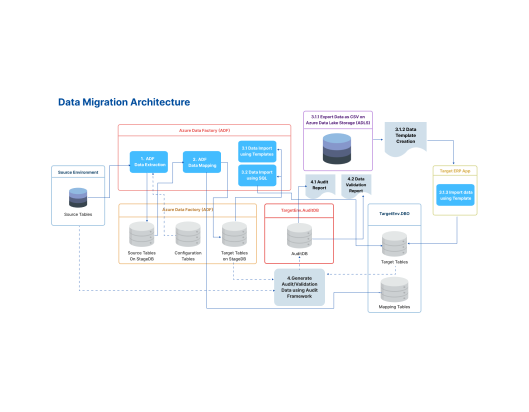

Secure Data Migration Journey For A Leading Construction Company

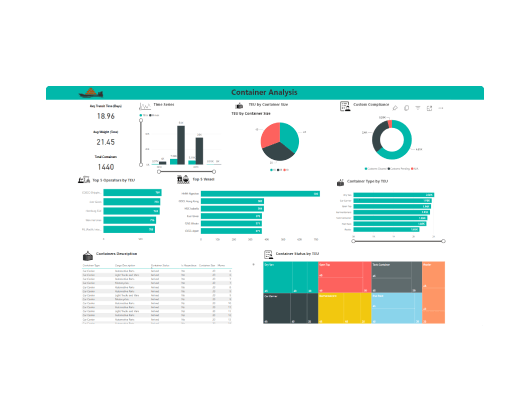

QlikView To Microsoft Power BI Migration

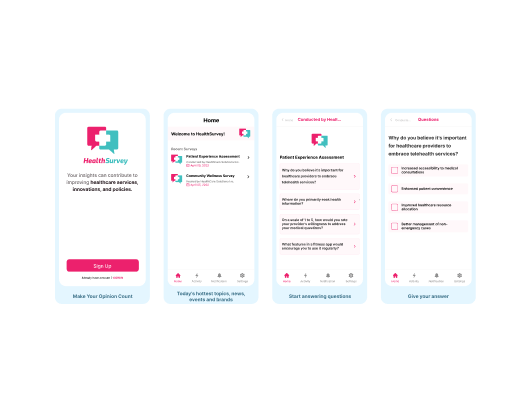

Comprehensive Healthcare Survey Application with Omni-Channel Capabilities

Our Source of Motivation